My Child Just Graduated From College and I Have Parent PLUS Loans. Now What??

Watching your child walk across the stage to receive their college diploma is a moment of immense pride. But for many parents, that joy is tempered by the looming reality of repaying the Parent PLUS loans they took out to make their child’s education possible. These loans, designed to help parents cover the cost of their child's undergraduate education, come with their own set of challenges, especially when it’s time to start repayment.

In this comprehensive guide, we'll explore what Parent PLUS loans are, how they work, the potential pitfalls, and the strategies you can use to manage repayment effectively. Whether you’re feeling overwhelmed or just looking for ways to minimize the financial impact, this article will provide you with the tools and knowledge you need to make informed decisions.

What Are Parent PLUS Loans?

Parent PLUS loans are Federal student loans issued by the U.S. Department of Education. They are available to parents of dependent undergraduate students to help pay for college costs not covered by other financial aid. Unlike other Federal student loans, Parent PLUS loans have no fixed borrowing limit. Instead, you can borrow up to the full cost of attendance, minus any other financial aid your child receives.

This flexibility is both an advantage and a risk. On one hand, it allows you to ensure your child can attend the college of their choice without financial barriers. On the other hand, it can lead to significant debt that must be carefully managed to avoid financial strain.

Key Features of Parent PLUS Loans

Borrowing Limits: The amount you can borrow through Parent PLUS loans is determined by the cost of attendance at your child’s college, minus any other financial aid they receive. This can include tuition, room and board, books, and other expenses. The total amount is typically much higher than what your child can borrow through undergraduate Federal loans, which are capped at lower amounts.

Credit Check Requirements: To qualify for a Parent PLUS loan, you must pass a credit check. However, the criteria are more lenient compared to private loans. The Department of Education checks for adverse credit history, which includes factors like recent bankruptcies, foreclosures, or defaults on other debts. If you have no significant negative marks on your credit, you’re likely to be approved.

Interest Rates and Fees: Parent PLUS loans carry higher interest rates and fees compared to other Federal student loans. For the 2024-2025 academic year, the interest rate on Parent PLUS loans is 9.08%, and there’s an origination fee of 4.228%. These rates can add up quickly, making it crucial to plan your repayment strategy early.

Interest Accrual: Interest on Parent PLUS loans begins to accrue as soon as the loan is disbursed, even while your child is still in school. This means that by the time your child graduates, the total amount you owe could be significantly higher than the original loan balance.

Example: If you took out a $20,000 Parent PLUS loan during your child’s freshman year, the origination fee would add $883 to the loan, bringing the total to $20,883. With an interest rate of 9.08%, the loan would accrue approximately $1,900 in interest each year. By the time your child graduates, that $20,000 loan could grow to over $29,400. This example underscores the importance of understanding how interest accrues and planning accordingly.

Repayment Options: Repayment on Parent PLUS loans typically begins 60 days after the loan is fully disbursed. However, you can request to defer payments while your child is in school and for six months after they graduate or drop below half-time enrollment. During deferment, interest will continue to accrue, though you are still allowed to make payments to your loans. Once repayment begins, any unpaid interest will be capitalized (added to the principal balance).

When Do Payments Start?

Repayment on Parent PLUS loans begins six months after your child graduates, leaves school, or drops below half-time enrollment. Notably, you can stay in or re-enter deferment if your child enters graduate school.

If your child graduated in May, your first payment will likely be due in November or December. It’s important to note that interest continues to accrue during this six-month grace period, which means the total amount you owe when repayment begins will be higher than what you initially borrowed if you don’t make any payments during this period.

Knowing when your payments will start can help you plan your finances and avoid any surprises. If you’re concerned about your ability to make payments, it’s crucial to explore your options before the first payment is due.

Deferment and Forbearance Options

If you’re not ready to start making payments, you have options to temporarily pause repayment.

Deferment: You can request a deferment on your Parent PLUS loans while your child is enrolled at least half-time and for six months after they graduate or leave school. During deferment, you’re not required to make payments, but interest will continue to accrue. It’s important to note that once deferment ends, any accrued interest will be capitalized, which can significantly increase your loan balance.

How to Apply: To request a deferment, you’ll need to submit a Parent PLUS Borrower Deferment Request form to your loan servicer. Some schools may automatically place your loan in deferment while your child is enrolled, but it’s important to confirm this with your loan servicer.

Forbearance: If you’re experiencing financial hardship, you can request forbearance, which allows you to temporarily pause or reduce your loan payments. Like deferment, interest will continue to accrue during forbearance. Forbearance is typically granted for up to 12 months at a time, but you can request additional periods if needed.

Making Payments During Deferment or Forbearance: Even if your loans are in deferment or forbearance, you can still make payments to reduce the overall interest accrual. This can be particularly beneficial if you’re trying to keep your loan balance from growing too large.

Understanding Repayment Plans for Parent PLUS Loans

Parent PLUS loans offer several repayment plans, but not all of them are created equal. It’s important to choose a plan that fits your financial situation and long-term goals. Further, these plans can be grouped into two different options: fixed and income-driven.

Fixed Repayment Plans

Standard Repayment Plan: This plan offers fixed monthly payments over a 10-year period. It’s the default option for most borrowers and results in the highest monthly payments but the least amount of interest paid over time among the fixed options.

Extended Repayment Plan: This plan extends your repayment period up to 25 years, reducing your monthly payments but increasing the total interest paid. It’s a good option if you need lower monthly payments but don’t qualify for income-driven repayment plans.

Graduated Repayment Plan: With this plan, your payments start low and increase every two years. The loan term for this plan is 10 years. It’s designed to accommodate borrowers who expect their income to increase over time.

Extended Graduated Repayment Plan: Technically, this is a sub-option of the Extended Repayment Plan above. The loan is repaid over 25 years, with payments starting low and gradually increasing every two years. Out of the fixed repayment options, the monthly payment here starts out the lowest.

Side note on the fixed repayment options if you consolidate your loans:

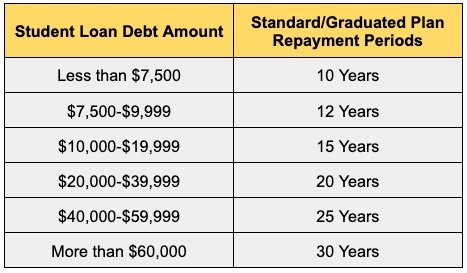

The repayment period on the Standard and Graduated plans actually changes if you consolidate your loans. The length is determined by the amount being consolidated:

Income-Driven Repayment (IDR) Plans

Income-Contingent Repayment (ICR) Plan: While Parent PLUS loans are not directly eligible for most income-driven repayment plans, you can consolidate them into a Direct Consolidation Loan to become eligible for the ICR plan. ICR bases your payments on your income and family size, making it more affordable if your income is lower.

Double Consolidation Strategy: Since ICR payments can be incredibly restrictive, the double consolidation strategy can help lower your monthly payments even further. Though it involves multiples consolidations, this strategy can make them eligible for the Income-Based Repayment (IBR), Pay As You Earn (PAYE), or Saving on A Valuable Education (SAVE)* plans, which can offer even lower payments than ICR. However, be aware that the double consolidation loophole is set to close on July 1, 2025, so it’s important to act soon if you’re considering this strategy.

Loan Forgiveness Through the Use of IDR Plans

The following forgiveness programs are only available through the use of IDR plans:

Public Service Loan Forgiveness (PSLF): If you work in the public sector or for a non-profit, you may be eligible for PSLF, which forgives the remaining balance on your loans after 120 qualifying payments under an income-driven repayment plan. Any remaining balance is forgiven tax-free.

Standard Forgiveness: The standard repayment length changes based on the IDR plan and is either 20 or 25 years. After making qualifying payments* on one of these plans for the required amount of time, the remaining balance on your loans is forgiven. Under current rules, the forgiven amount is considered taxable income in the year it is forgiven.

Planning Takeaway: coupled with loan forgiveness, using an IDR plan can be much more effective than using one of the fixed repayment plans to pay off the loan/s completely. As your Federal loan balance increases, all else being equal, the more loan forgiveness makes sense.

Factors to Consider When Choosing a Repayment Strategy

Choosing the right repayment strategy for your Parent PLUS loans depends on several factors, including your loan balance, income, employment status, and long-term financial goals. Here are some key considerations:

Loan Balance: The amount you owe will influence your repayment plan options. Larger balances may require extended repayment periods or income-driven plans to make payments manageable.

Income and Employment: Your current income and job stability will play a significant role in determining the best repayment plan. If you’re working in the public sector or for a non-profit, PSLF could be a viable option that saves you a LOT of money, but it requires careful planning.

Future Education Costs: If you have other children who will be attending college, you’ll need to consider how those future costs will impact your ability to repay your Parent PLUS loans.

Retirement Plans: If you’re nearing retirement, you’ll need to think about how your income will change and whether you’ll be able to continue making loan payments. In some cases, income-driven repayment plans may be beneficial because they adjust your payments based on your income.

Interest Rates: Given the high interest rates on Parent PLUS loans, refinancing may be an option to explore. However, refinancing with a private lender will cause you to lose access to Federal loan protections, so it’s important to weigh the pros and cons carefully.

Final Thoughts: Navigating Parent PLUS Loan Repayment

Managing Parent PLUS loans after your child graduates can be challenging, but with the right knowledge and strategy, you can navigate repayment effectively. Whether you choose to take advantage of deferment, explore income-driven repayment options through double consolidation, or consider refinancing, it’s important to take a proactive approach.

If you’re feeling overwhelmed or unsure about the best course of action, consider consulting with a student loan expert who can help you develop a personalized repayment plan. With careful planning and informed decisions, you can manage your Parent PLUS loans in a way that minimizes financial stress and helps you achieve your long-term financial goals.

By taking the time to understand your options and plan ahead, you can ensure that your Parent PLUS loans don’t become a burden but are instead managed in a way that supports your financial well-being.

How To Reach Me

Join my newsletter to learn more about my services and receive updates when I publish new articles.